carried interest tax changes

Carried Interest The Tax Loophole That Won T Die The New York Times

The Sec 1061 Capital Interest Exception And Its Impact On Hedge Funds

Pin By Erik Yamada On How To Pick A Fantastic Poultry Freezer Manufacturer For Your Project Needs Global Recipes Sustainable Food Systems Food Infographic

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

What Is E Way Bill Under Gst Goods And Services Internet Usage Goods And Service Tax

How To Boost Portfolio Returns With Tax Loss Harvesting Strategies Bny Mellon Wealth Management

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

How Does Carried Interest Work Napkin Finance

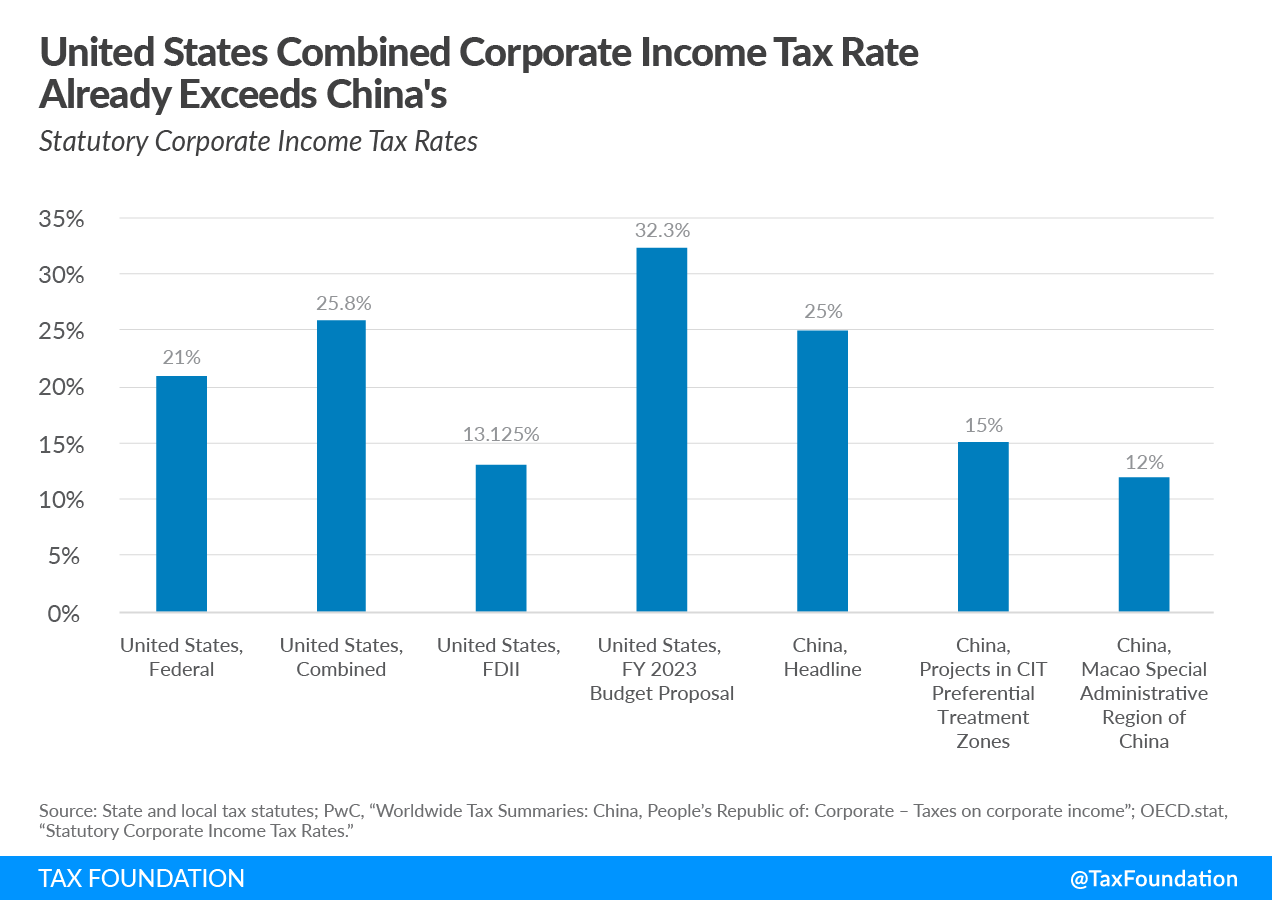

Us China Competition Usica Competes Act Corporate Tax Comparison

How Does Carried Interest Work Napkin Finance

What Kyrsten Sinema S Tax Provision Cut Means For Rich Investors

Fact Sheet Close The Carried Interest Loophole That Is A Tax Dodge For Super Rich Private Equity Executives Americans For Financial Reform

What Closing The Carried Interest Loophole Means For The Senate Climate Bill Npr

Shopping For Backpacks Heed These Safety Tips Memorial Hermann Childrens Health Safety Tips Primary Teaching

Carried Interest Tax Loophole Part Of Manchin Inflation Bill

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Income Tax Increases In The President S American Families Plan Itep